option to tax form

Prep E-File with Online IRS Tax Forms. Rent it out without opting to tax and you wont be able to claim the VAT back.

What Are The Two Options Singapore Companies Have When Filing Their Tax Returns What Is The Difference Between Form C And Fo Tax Return Singapore Filing Taxes

Use form VAT1614C for revoking an option to tax land or buildings within 6-month cooling off period.

. There are three variants. Option to tax form pdf Option to Tax Disapplication My client is a VAT registered Ltd Co that owns a portfolio of rental properties both commercial and residential. These are generally options contracts given to employees as a form of compensation.

Ad IRS-Approved E-File Provider. 10 June 2022 Form Revoke an option to. Select the document you want to sign and click Upload.

VAT1614C - revoking an option to tax within 6 month cooling off period Use form VAT1614C for revoking an option to tax land or buildings within 6-month cooling off period. However when you exercise a non-statutory stock option NSO youre liable for ordinary income tax on the difference between the price you paid for the stock and. In order to reclaim the VAT my client opted to tax.

The company purchased some land adjacent to a pub on which they incurred VAT. For tax purposes options can be classified into three main categories. Request for Taxpayer Identification Number TIN and Certification Form 4506-T.

Opry Mills Breakfast Restaurants. The option to tax allows a business to choose to charge vat on the sale or rental of commercial property ie. For example you need a VAT 1614A in a different situation to a VAT 1614D.

Restaurants In Matthews Nc That Deliver. Follow the step-by-step instructions below to design youre vat 5l form. Sign Online button or tick the preview image of the form.

Delivery Spanish Fork Restaurants. Refer to Publication 525 for specific details on the type of stock option as well as rules for when income is reported and how income is reported for income tax purposes. For example incentive stock options.

Form Disapply the option to tax land sold to housing associations. The advanced tools of the editor will guide you through. When you exercise an incentive stock option iso there are generally no tax consequences although you will have to use form 6251 to determine if you owe any alternative minimum tax amt.

Important local option tax forms. In general taxpayers still have the option to submit a paper version of the Form 1040-X and should follow the instructions for preparing and submitting the. A typed drawn or uploaded.

When you exercise an ISO your employer issues Form 3921Exercise of an Incentive Stock Option Plan under Section 422b which provides the information needed for tax-reporting purposes. The timing of submission is important. Before you complete this form it is strongly recommended that you read Notice 742A Opting to tax land and buildings available from our website go to wwwhmrcgovuk A paper copy and general guidance are available from our advice service on 0845 010 9000.

Form for Notification of an option to tax Opting to tax land and buildings on the web. Whether taking an 83 b election or. The OTT provisions do not differentiate between commercial or residential land or buildings and therefore whilst it is more common.

Soldier For Life Fort Campbell. Certificate to disapply the option to. 8 October 2014 Form Apply for permission to opt to tax land or buildings.

Opt to tax land andor buildings. Over 50 Milllion Tax Returns Filed. Revoke an option to tax for vat purposes within the first 6 months use form vat1614c for.

County Option Dog Tax Registration Form. When you exercise an incentive stock option ISO there are generally no tax consequences although you will have to use Form 6251 to determine if you owe any Alternative Minimum Tax AMT. Forms 1040 and 1040-SR can still be amended electronically for tax years 2019 2020 and 2021 along with amended Form 1040-NR and corrected Forms 1040-SS and Form 1040-PR for tax year 2021.

16 2021 stock swap na cash buy na status expected tax form. Blue Summit Supplies Tax Forms 1099 Misc 4 Part Tax Forms Bundle With Software And Self Seal Envelop In 2021 Tax. To get started on the form use the Fill camp.

Send the completed form and supporting documents to the. Please complete this form in black ink and use capital letters. As it is a new commercial property you will be charged VAT.

Option To Tax Form. For example puts or calls on individual stocks. Follow the step-by-step instructions below to design youre vat 5l form.

Online Federal Tax Forms. BANK All valid sales and use tax filers with account in an active status can use this system and there is no registration. Essex Ct Pizza Restaurants.

In fact you may also be able to claim ongoing expenses and other associated costs. I tend to remember option to tax forms by their numbers and letters. It also applies to any buildings that are subsequently built on that land.

This notice has been updated to provide information on who is an authorised signatory for the purposes of notifying an option to tax the details can be found in a new paragraph 76. However when you opt to tax you can get your cash back. Form vat1614a209 form for notification of an option to tax opting to tax land and buildings on the go.

If you do opt to tax you will need to charge the tenant VAT. Electronic Payment Options for Quarter-Monthly Weekly Sales Tax Filers Form 2414S Revised 12-2017 Option 1. 2011 Nothing from June 25 2022 to July 2 2022.

Income Tax Rate Indonesia. Although it is common to refer to a property when notifying an Option to Tax OTT an OTT actually applies to the land and includes the building standing on the land. March 1 2022.

The relevant form to send to HMRCs Option to Tax Unit in Glasgow is VAT1614A which means that the landlord does not need HMRCs permission to opt because he has not made any previous exempt supplies in relation to the building see below re. The company is now in the process of selling the. Decide on what kind of signature to create.

County Option Dog Tax Registration Form. Form Revoke an option to tax for VAT purposes within the first 6 months. Call HMRC for help on opting to tax land or buildings for VAT purposes.

A one-page tax filing called an 83 b election is what individuals use to take advantage of this tax option. Options contracts on equities that can be traded on the open market. The timing of submission is important.

Incentive Stock Option - After exercising an ISO you should receive from your employer a Form 3921 Exercise of an Incentive Stock Option Under Section 422b.

Checklist For Acquisitions 2 Real Estate Forms Writing A Book Review Lettering

Free Colorado Power Of Attorney Forms Pdf Templates Power Of Attorney Form Power Of Attorney Attorneys

Philadelphia Taxes Filing Taxes Tax Forms Tax Advisor

Pin On Tds Return Filing Software

What Is Form 4506 C Ives Request For Transcript Of Tax Return Tax Return Budget Planning Financial Tips

Pin By The Project Artist On Understanding Entrepreneurship When Someone Starting A Business Understanding

Pin On Legal Form Template Waiver Download

Tax Due Dates Stock Exchange Due Date Tax

Pin By Olivia Reyes On Pta Donation Letter Pto Fundraiser School Pto

Income Tax Return Update Financepost In 2021 Finance Blog Finance Income Tax Return

Tx302 Payroll Withholding Tax Essentials Payroll Taxes Payroll Medical Insurance

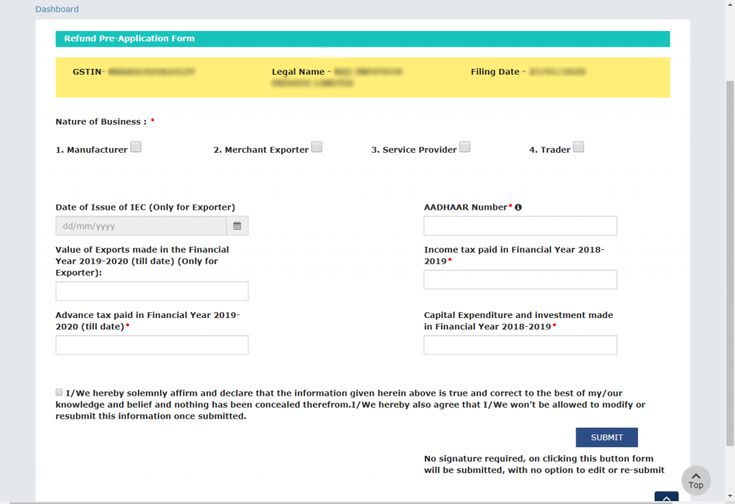

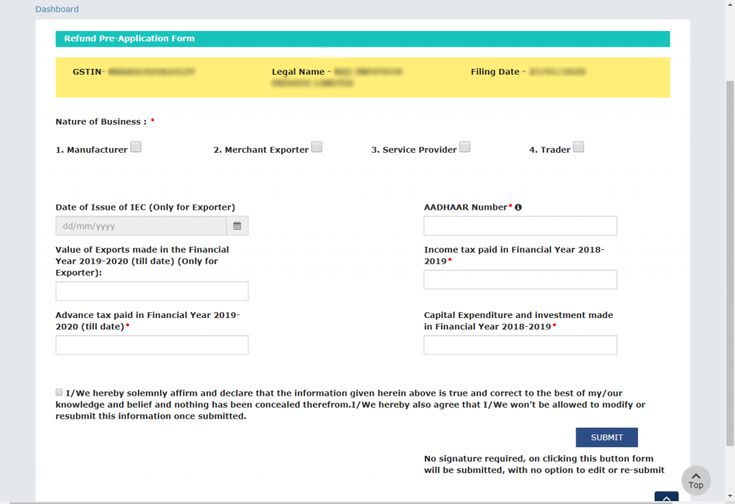

Gst Portal New Feature On Pre Fill An Application Form For Refund Tax Refund Application Form Filing Taxes

Blue Summit Supplies Tax Forms 1099 Misc 5 Part Tax Forms Kit 100 Count Security Envelopes Small Business Accounting Software Business Accounting Software

Tds Return Due Dates Due Date Months Make It Simple

Summary Of Income Tax Provisions For Ay 2021 22 Under Both Old New System Indian Stock Market Hot Tips Picks In Shares Of India In 2021 Income Tax Income Tax