us germany tax treaty withholding rates

Rate of withholding tax Interest. You claim a reduced rate of withholding tax under a treaty on interest dividends rent royalties or other fixed or determinable annual or periodic income ordinarily subject to the.

Use Base Model Vectigal Corporation

An Income Tax Treaty like the income tax treaty between Germany and the United States is designed to minimize inconsistent and double taxation although a tax treaty cannot.

. The reduced 5 withholding tax rate would not be available for RICs but the. The treaty permits a reduction of the 30 percent branch profits tax to 5 percent or lower on the dividend equivalent amount. On February 11 2021 the German Federal Ministry of Finance GFMF published a decree the Decree confirming their position that German withholding tax at a rate of.

The Federal Republic of Germany will reduce its withholding rate on dividends paid to United States portfolio investors on a non-reciprocal basis from 15 percent to 10 percent. 30 tax rate if shareholder owns 25 or more of the REITs stock. The Protocol would continue to limit the withholding tax on dividends paid by a US.

62 rows Last reviewed - 01 August 2022. The complete texts of the following tax treaty documents are available in Adobe PDF format. The United States withholding rate on such dividend to German investors will remain at 15 percent.

Germany - Tax Treaty Documents. See Article 10 10 of the United States- Germany Income Tax. 15 tax rate if shareholder owns more than 50 of the REITs voting stock.

98 rows Interest paid to non-residents other than on convertible or profit. Like many countries Germany imposes a withholding tax on dividends paid to foreign investors. 15 15 to 25 20.

If you have problems opening the pdf document. Overview Under these treaties residents not necessarily citizens of foreign countries may be eligible to be taxed at a reduced rate or exempt from US. 20 tax rate if shareholder owns at least.

The payee can claim a reduced rate of withholding tax under a treaty on interest dividends rent royalties or other fixed or determinable annual or periodic income ordinarily subject to the 30. Source gross income that is not effectively connected with. The reduced 5 withholding tax rate would not be available for RICs but the exemption from withholding tax on dividends described above would be available for dividends.

Under US domestic tax laws a foreign person generally is subject to 30. 0 14 for individual 14 for distribution of profit from. Under US domestic tax laws a foreign.

Income taxes on certain items of. Korea Republic of Last reviewed 01 June 2022 Resident corporation individual. You must withhold tax at the statutory rates shown below unless a reduced rate or exemption under a tax treaty applies.

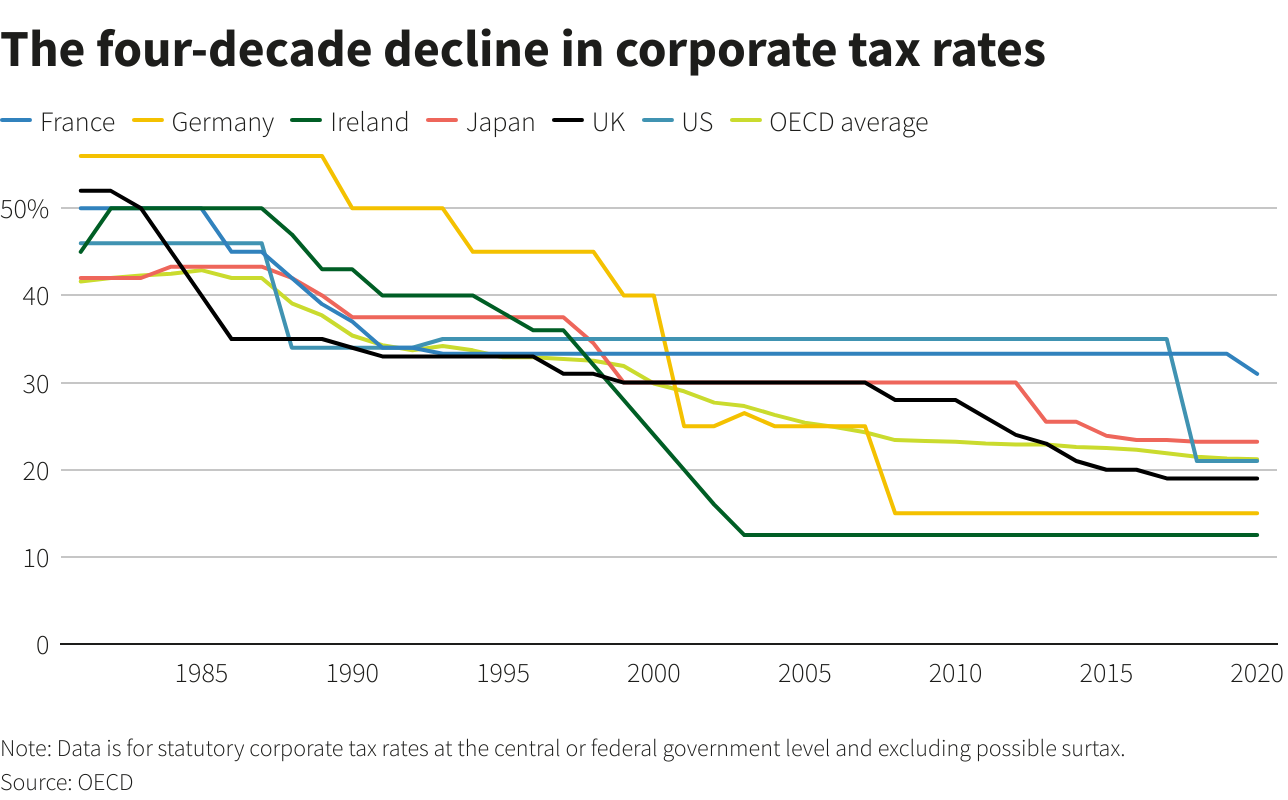

Corporate Tax Rates 2022 includes information on statutory national and local corporate income tax rates applicable to companies and branches as well as any applicable branch tax imposed. In the absence of a tax treaty this tax is imposed at a rate of 251A recent.

Global Tax Deal Seeks To End Havens Criticized For No Teeth Reuters

The Ins And Out Of Us Taxation For German Citizens

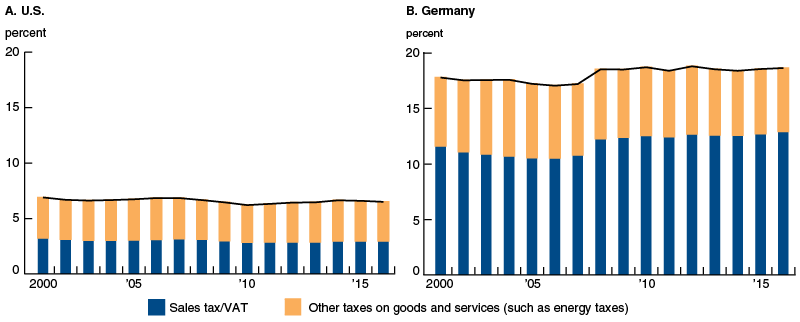

Double Taxation Of Corporate Income In The United States And The Oecd

Status Of Russia S Initiative On Amending Its International Tax Treaties To Increase Withholding Tax Rate On Dividends And Interest To 15 Percent Deloitto China

The Burden Of Taxation In The United States And Germany Federal Reserve Bank Of Chicago

Withholding Tax Rates To Non Residents Download Table

:max_bytes(150000):strip_icc()/FormW-8BEN-E-414e383aa32d41d0bb6d9095f4861541.jpeg)

W 8ben When To Use It And Other Types Of W 8 Tax Forms

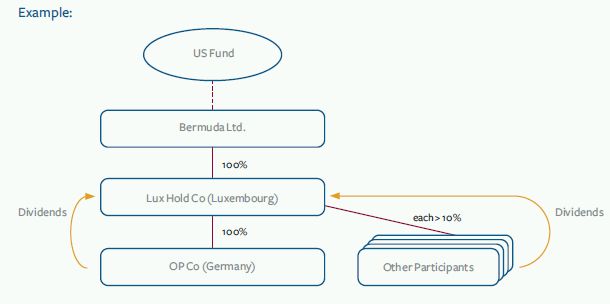

Double Tax Treaties In Luxembourg

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

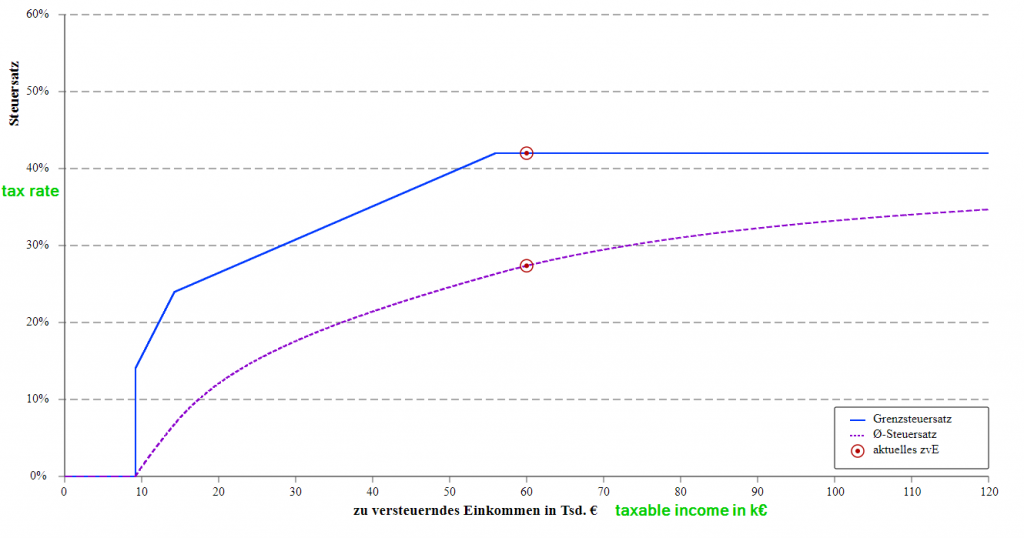

Faq German Tax System Steuerkanzlei Pfleger

Federal Insurance Contributions Act Wikipedia

Foreign Dividend Tax Rates How To Reclaim Withholding Tax In 2022

Getting Started Bloomberg Tax Bloomberg Tax

Form 8833 Tax Treaties Understanding Your Us Tax Return

Germany Usa Double Taxation Treaty

Refund Of German Withholding Taxes Good News For Foreign Investors Corporate Tax Germany